The concept of the Volume analysis and volume trading as the idea, has resulted from my deep studying of Market Profile technology (that number of the book Dalton "Mind over Markets") and emergence of a technological capability to create the operated structured databases storing all information on each transaction including about such major parameter as volume.

Integration of statistical data on the trading volume into the auction model of market development described by Peter Stadelmayeyr makes an ideological concept of the Volume analysis and Volume trading. Such system of the analysis of the market brings Market Profile concept to the new system level which is earlier not described and so in detail not structured as it has been made by the author of article at the beginning of 2 001.

In my opinion the most important isn't simple to visualize levels of the maximum volumes (DEWS) and the Zone of Cost of various intervals (it in itself gives very little), but, most important it to see development of an auction on various taymfreyma and how volumes (in fact visualization of money in the market, the true cost and degree of interest in this or that range) work in an auction and accurately specify from what category of bidders at present there is bigger pressure (the long-term or short-term trader, the buyer or the seller). The Market the Profile with personal experience, work with statistics our training programs, my book preparing for the edition are also devoted to art of such volume thinking and compilation of the best ideas of the theory and it is rather short – this article.

SYNTHESIS OF MARKET PROFILE AND STATISTICAL ANALYSIS OF THE TRADING VOLUME

The following components are important for a professional analytical concept:

- Understanding of market structure

- Vision of logic of development of the market and interrelation of all trade processes

- Timing

1. Market structure

The base of everything that we do, the view of the market, as on a double auction is.

The continuous auction process developing on various taymfrema: from the sentry to monthly is fundamentals of analytics, represents peculiar "pulling of a rope" between buyers and sellers.

From understanding of development of a long-term auction vision of market opportunities, determination of potential of day, creation of strategy, the description of risks and the choice of a time-frame for trade operations follow.

Than the auction is longer, especially it is difficult. Consisting of auctions various

(smaller) taymfrem, the intramarket relations and contradictions between actions long-term and intrady traders, it sometimes isn't simple to understanding and the analysis at all. That is why, most of the traders who are narrowly looking at a subject of auction trade, Markt of the profile and Volume analysis make so many mistakes, being focused only on short-term (day or week) an auction.

But only comprehensive, deep взляд (demanding enough efforts) on the market and studying of a long-term auction it is capable to create sufficient understanding of market processes, to point to emergence of big market

opportunities to save from vulnerability and misunderstanding, and finally to provide sure and comfortable trading within months and long years.

The structure of an auction has been described by Stadelmayer through AUCTION PHASES:

- Impulse phase

- Response

- Balance (or test)

- Impulse in the same or opposite direction.

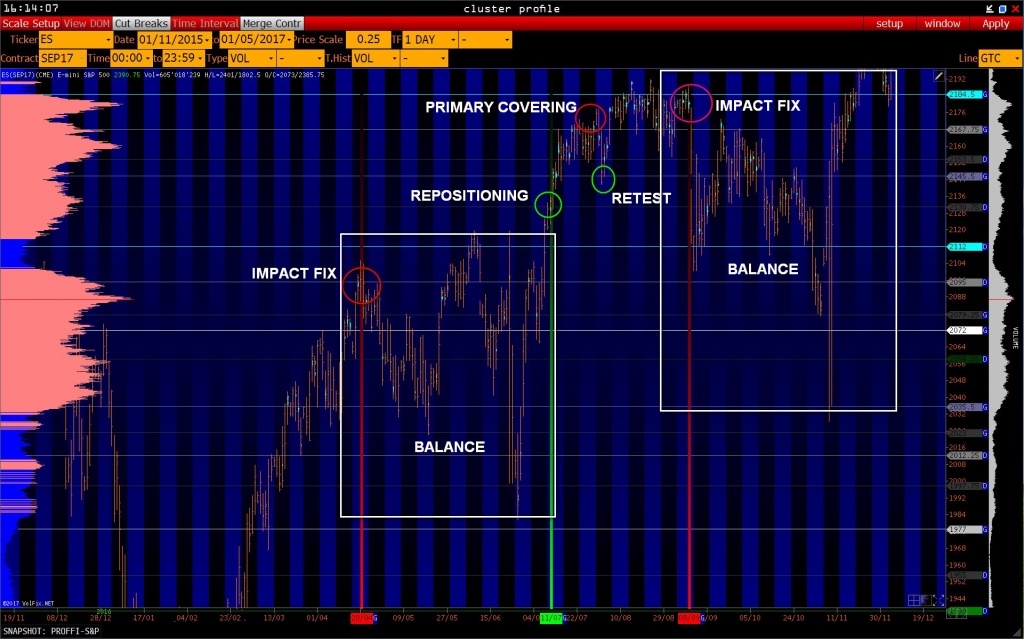

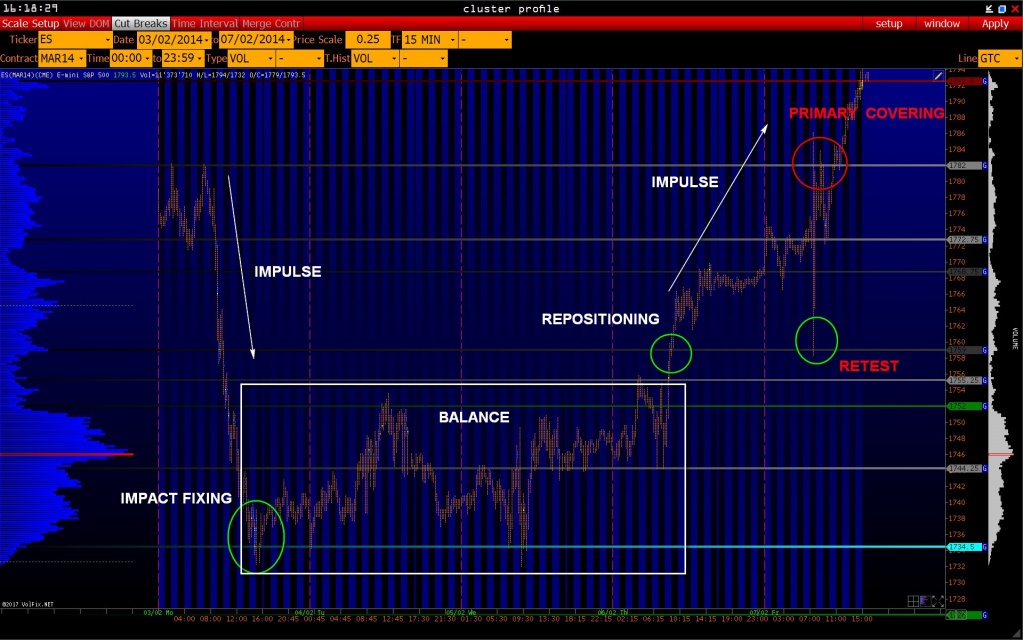

Now, compiling this structure with work with statistical data on the trading volume and a possibility of visualization of volumes through volume quotation, we receive a number of the interesting interrelations and logical chains helping to identify correctly auction phases, to count all components and to estimate potentials of all possible events:

For example: the response phase at the ascending movement is visualized as emission of significant volumes in an antitrend – "FIXING".

The statistics gives us the chance to estimate parameters of "fixing", his importance, potential on short circuit of the previous phase of an auction. (We apply the same principles of work with statistics also to a balance phase, and to pulse).

One of advantages of technology of Volume trade is the universality!

Really, rules of work with statistics in phases of an auction are universal for various financial instruments and various taymfrema.

All reviewed examples distinctly illustrate the main regularities during the work with statistical data in auction model, but naturally don't open all subtleties and nuances, necessary, for professional work

(for development of all details we invite to our Basic course and the course Professional).

I distinguish ability to see interrelation of auctions of various taymfrem from a set of important nuances and valuable skills – through analytics.

2. Vision of logic of development of the market and interrelation of all trade processes

The contextual understanding of statistics on volumes, emergence of new significant volumes arises, as a result of forming of through analytics – the analytical process considering development of an auction on various time intervals and opening the mechanism of use of this development.

The habit to think of parameters of through analytics is developed gradually, but only she saves from precipitate trades and the underestimated market opportunities. The fact that we see in day trading – only a part of process of settlement of the highest taymfrem is very frequent. Without this understanding and without skill of through analytics it is very difficult to achieve contextual understanding and understanding of why there are these or those events in the market. On the other hand, having armed with this valuable skill, you will increase the potential of definition of market opportunities and keep flexibility of thinking and perception of all information generated by an auction on different taymfrema.

Below I give only two examples, reflecting – coincidence of auctions occurring at different times, and as a result formation of a long-term impulse, and the second example – opposition of a long-term and week-long auction and formation of a reverse.

Forming predictive analytics within TRADING ROOM we use work at least in trekhtaymfreymovy structure. Also technologies intrady – trading and the program of a master class in this popular subject are connected with contextual thinking.

3. Timing

The combination of the analysis of volume and time is the next major moment for professional analytics. Statistical data on the trading volume certainly are important (and are base of the Volume analysis), but only in combination with the analysis of time (timing) creates the logical sequence in a research of market processes. In fact, time is the regulator of market opportunities.

Vision of development of an auction in time – the fine tool for definition of "an efficiency point" - that is the moment when the market is ready to pass from a phase of balance of a phase of an impulse and to give market opportunities for realization.

It was always important for me when and as (in what context) significant volume appears:

- Whether there is he uniform surgical strike

- The wound collects rotation

- As it is long formed in balance

- What rhythmic organization of emergence of significant volumes in day

(weeks, contract)

- As far as we mean the volume closing a session and which is formed in the first two hours of the auction

- When there are abnormally large volumes

- It isn't less important to see and trace time of emergence of low volumes, the movement in the "thin" market – a harbinger of end of an impulse.

Answers to these and many other questions are the center of the Basic course and the course Professional

And at last, the major aspect – the choice of your personal taymfrem – a time interval of the auction comfortable only for you. It is a basis of creation of strategy and base of adequate perception the place in global market process.